dependent care fsa vs tax credit

Get a free demo. Dependent Care FSA.

2021 Changes To Dcfsa Cdctc White Coat Investor

Ad Learn Tax Consultant Certification - Best Tax Consulting Training - Free Tax Questions.

. The purpose of the change in the Taxpayer Certainty and. For Dependent Care Credit lets say you did max FSA expanded with the March 2021 tax law change but also spent the max on care. The higher your income the lower the credit.

The child and dependent care tax credit can potentially put a lot of money directly into. Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

If you pay more than 11000 in childcare costs Max out the FSA by contributing 5000 to it then claim the tax credit using the remaining 6000 in costs that werent reimbursed from the. Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. Instead the dependent care.

Easy implementation and comprehensive employee education available 247. AGI 100000 and DCSFSA row 5 with 5000 state CA row 23 original credit and 24 new credit provide 1500 and row 26 original child tax credit and row 27 new tax credit. But like the Dependent Care FSA the American Rescue Plan Act ARPA has also increased the credit limits for the Child and Dependent Care tax credit for 2021.

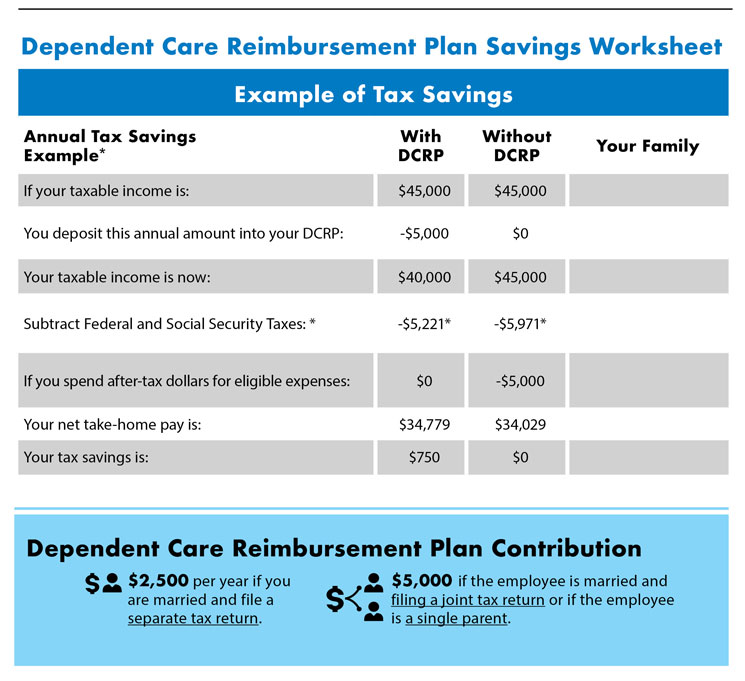

Elevate your health benefits. Dependent Care Tax Credit Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid. The annual maximum pre-tax contribution may not exceed 5000 per year regardless of number of children.

The intention of the Dependent Care FSA is to collect tax-advantaged dollars to pay for child and dependent care. For the majority of individuals earned income is your annual wages minus any non-taxable items such as traditional employer retirement account contributions 401k 403b etc health care. 5000 is the maximum whether for one child or.

8000 per child max 16000. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. I missed it when it was first announced but I just saw the changes to the dependent care FSA and dependent care tax credit and now Im not sure which would be better or if we can even change.

Up to 25 cash back Under the regular rules without a dependent care account you could claim a child care credit of 20 of 3000 amounting to 600. The FSA saves you 20 state tax rate in taxes on 5k the credit returns 50 of expenses though expense amount is reduced by whatever you pay through the FSA. For example you cant claim the same eligible expense through a dependent care FSA and the tax credit.

You can take a tax credit worth 20 to 35 of the cost of care up to 3000 for one child or up to 6000 for two or more children. Ad Custom benefits solutions for your business needs.

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

2021 Changes To Dcfsa Cdctc White Coat Investor

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Coh Dependent Care Reimbursement Plan

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

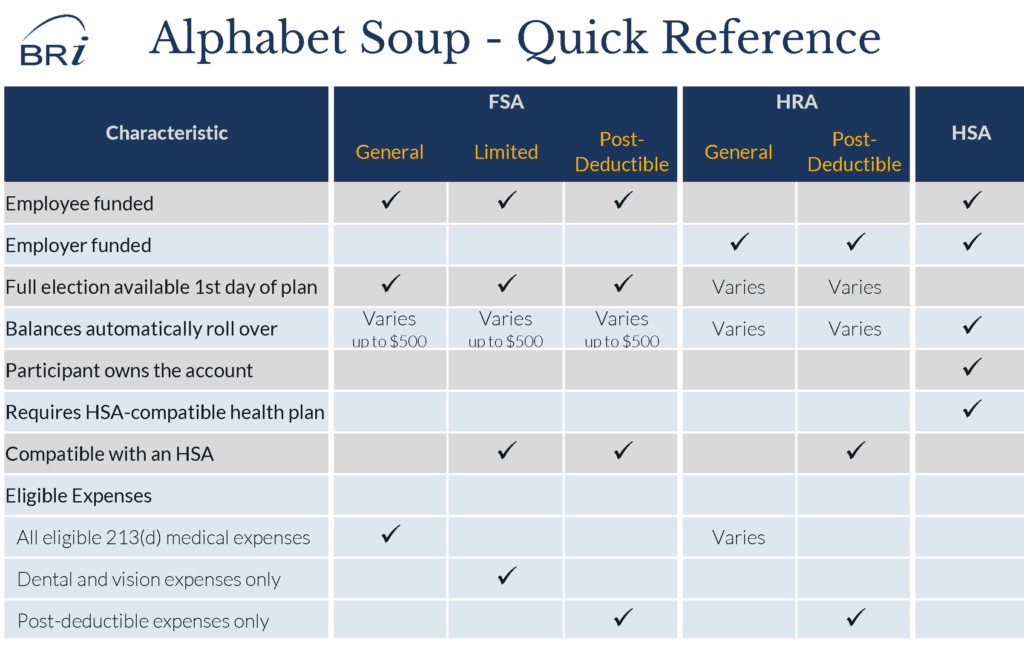

The Perfect Recipe Hra Fsa And Hsa Benefit Options

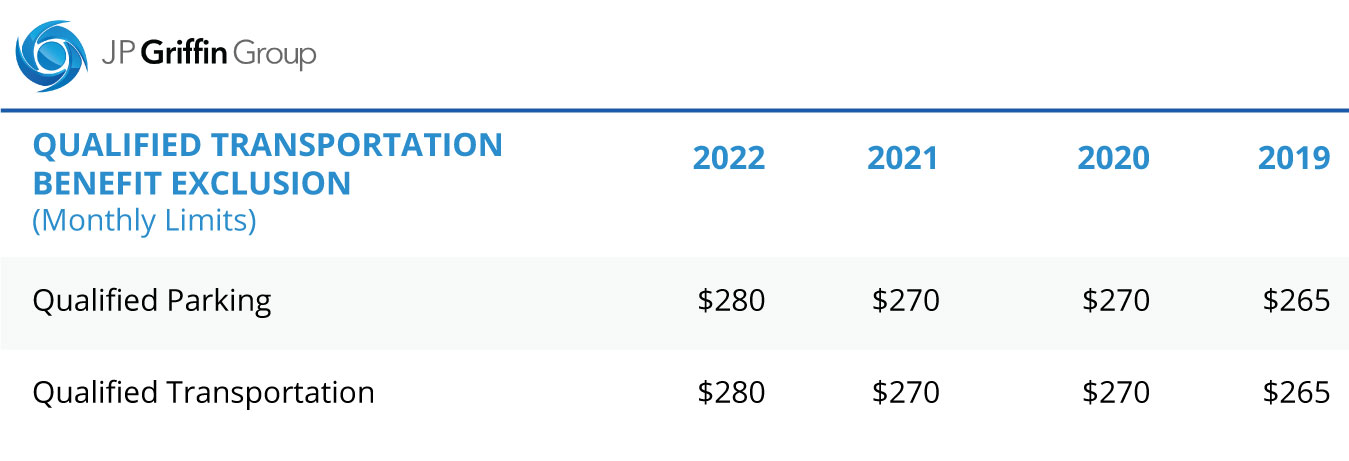

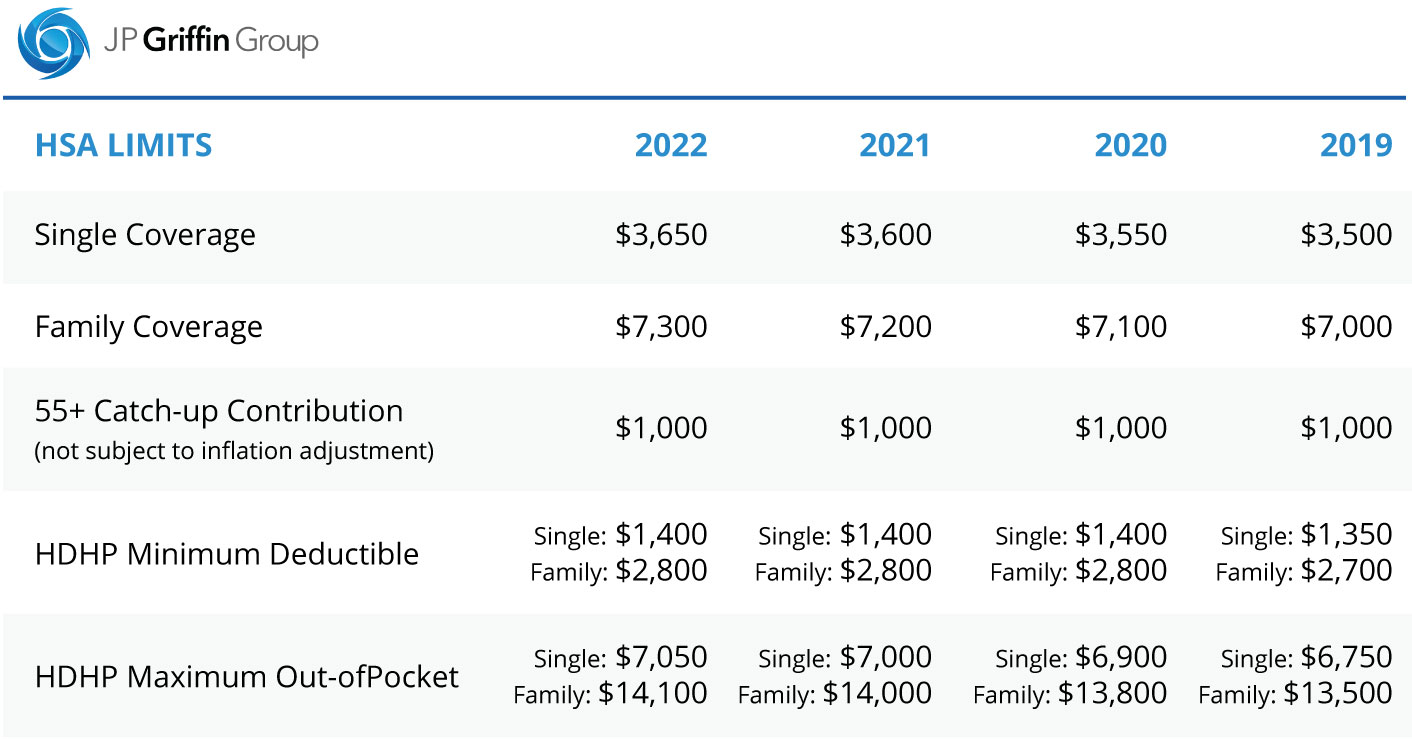

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2021 Changes To Dcfsa Cdctc White Coat Investor

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Tax Implications And Rewards Of Grandparents Taking Care Of Grandchildren The Cpa Journal

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Changes To Dcfsa Cdctc White Coat Investor

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Are Virtual Day Camps And Daycare Eligible Under A Dependent Care Fsa Vita Companies

:max_bytes(150000):strip_icc()/child-and-dependent-care-tax-credit-3193008_final-b08e8070d5604c59b7ab83438a7c3167.jpg)