us exit tax calculation

Green Card Exit Tax 8 Years Tax Implications at Surrender. Citizens Green Card Holders may become subject to Exit tax when relinquishing their US.

Exit Tax In The Us Everything You Need To Know If You Re Moving

The expatriation tax rule applies only to US.

. The Exit Tax Planning rules in the United States are complex. Currently net capital gains can be taxed as high as. Citizens and long-term residents must carefully plan for any proposed expatriation from the US.

In order to calculate the amount of exit. In some cases you can be taxed up to 30 of your total net worth. Legal Permanent Residents is complex.

Why does exit tax exist. Generally if you have a net worth in excess of 2 million the exit tax will apply to you. A person not excepted under either the dual-citizen or the age 18½ provision will thus need to take inventory of his or her assets in addition to assessing.

The exit tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. If a person is a US. Paying exit tax ensures your taxes are settled when you cease to be a US tax resident.

Citizenship or long-term residency triggers both the exit tax and the. Income tax liability after foreign tax credits for the 5 tax years ending before the date of your expatriation. The exit tax calculation.

Calculating the exit tax is tricky in general but if youve got retirement accounts and foreign pensions it jumps to a whole new level of complexity. In order to calculate the amount of. It applies to individuals who meet certain thresholds for annual income net worth.

In direct answer to Ms question you will pay tax once and once only when you exit the United States. The Exit tax occurs from US. Us exit tax calculation Saturday February 26 2022 Edit.

If you have US5 million in gold that you bought at an average price of US1300 per ounce and the price of gold the day you. The income tax liability calculated under 871 of the. Citizens or long-term residents.

Youre going to get taxed by the IRS on that US1 million gain. The IRS considers the present net value. Persons at the time of expatriation from the United States.

The IRS Green Card Exit Tax 8 Years rules involving US. The exit tax process measures income tax not yet paid and delivers a final tax bill. How is exit tax calculated.

If you are covered then you will trigger the green card exit tax when you renounce your status. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. A long-term resident is defined as a lawful.

1st Year Before Expatriation 2nd Year Before Expatriation 3rd. Finally here is Ms answer. The Exit Tax itself is computed as if you sold all of your worldwide assets on the day before you expatriated.

The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. It will be as. Your average annual net income tax liability for the 5 tax years ending before the date of expatriation is more than the amount listed next.

Citizen or Long-Term Resident covered expatriate the exit tax. Generally if you have a net worth in excess of 2 million the exit tax will apply to you. Green Card Exit Tax 8 Years.

Exit tax is calculated using the form 8854 which is the expatriation statement that is attached on your final dual status return. In most cases it will be in one giant lump in the. Exit tax is the IRSs last chance to tax you and is essentially taxed as if you were to sell all your assets on the last day of living in the US.

If you are neither of the two you dont have to worry about the exit tax.

Hart Moden 4 20ma Signal Generator Calibration Current Voltage Pt100 Thermocouple Pressure Transmitter Logger Frequen Graphing Calculator Transmitter Generator

Exit Tax In The Us Everything You Need To Know If You Re Moving

Cesab Residual Capacity Calculator Diagnostic Tool Calculator Repair

Freebie Resources To Help You Teach Your Lesson On Operations With Complex Numbers Free Worksheet Guided Complex Numbers High School Math Number Worksheets

Entry Level Finance Jobs With No Experience Finance Jobs Finance Finance Blog

Hoshihrms Hoshi Payrollsoftware Webinar Taxwebinar Tax Offboarding Sme Business In 2022 How To Memorize Things Webinar Last Day At Work

Simple Tax Guide For Americans In Colombia

How Is Taxable Income Calculated

Simple Tax Guide For Americans In Colombia

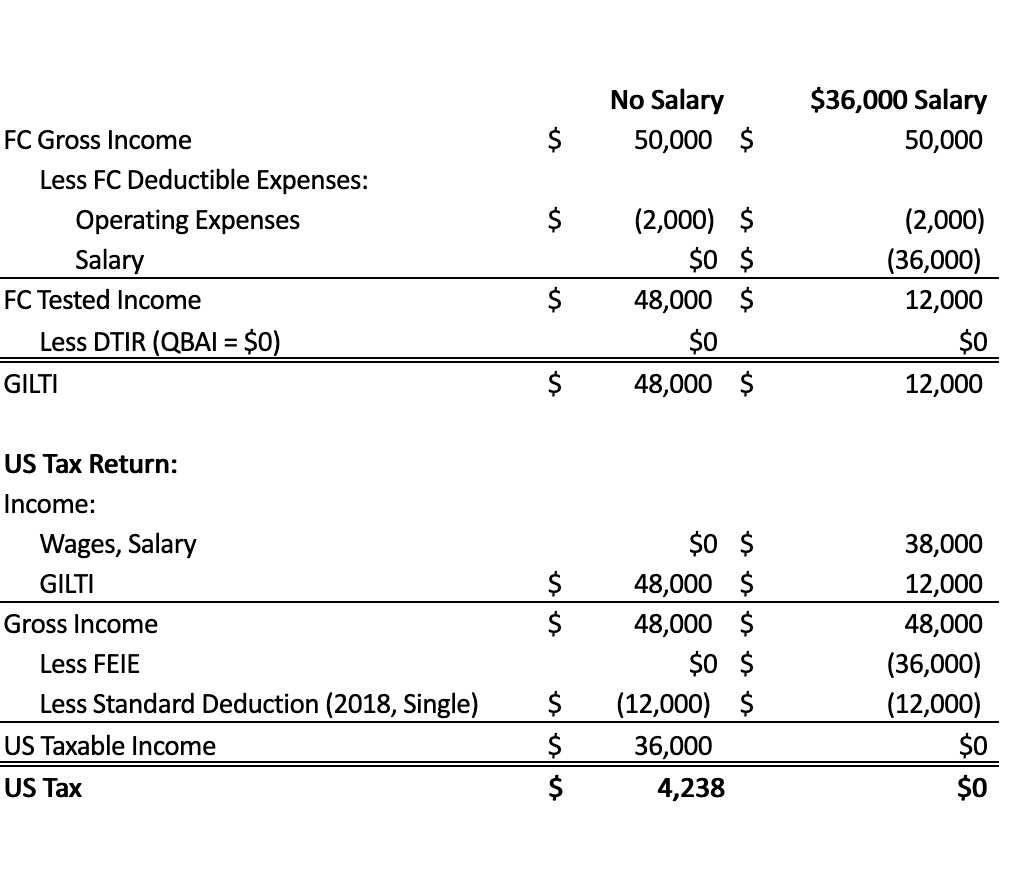

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Renounce U S Here S How Irs Computes Exit Tax

Many Of You Might Have Received A Hike In Salary For This Financial Year While Getting An Increment Fills Us W Ways To Save Financial Planning Financial Goals

How Is Taxable Income Calculated

Tax Calculation Flow Chart Download Scientific Diagram

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

Calculator Need To File Us Expat Taxes Myexpattaxes

Diverse Multiracial And Multicultural Group Of People Stock Vector Illustration Of Public Cartoon 173312246

Selling Your U S Property Is There U S Canadian Capital Gains Tax Altro Llp